Leading worldwide, rooted in Switzerland: Policy for a future-proof Swiss financial centre

A strong financial centre is key for the Swiss economy and Switzerland's standing as an international location. Switzerland should therefore maintain its place among world-leading, modern and globally active financial centres. The Federal Council wants to assist and support this with a sound and dynamic financial market policy.

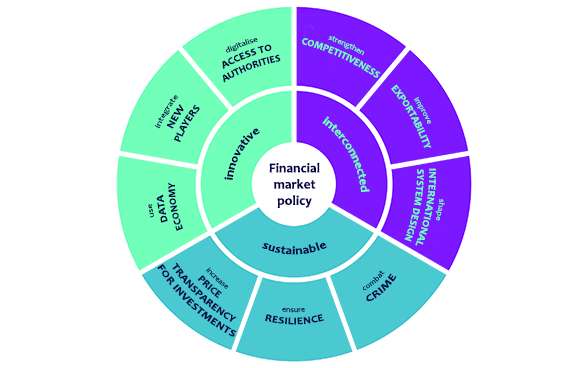

This financial market policy builds on traditional Swiss strengths such as high productivity, stability, security and trust. In order to maintain a leading position on the international stage in the future while also meeting the needs of the population, these strengths need to be combined with an openness for new technological and international developments, and efforts to increase international competitiveness. In its new strategy presented here, the Federal Council has therefore defined nine specific areas of action for a future-proof Swiss financial centre under the three key thrusts "innovative", "interconnected" and "sustainable".

Innovative

Existing and new financial centre players must be able to exploit the many possibilities offered by new technologies and data-driven business models in an optimal manner. To enable this, the Federal Council is creating a technology-neutral regulatory framework for digital access, digitalising the interfaces with the authorities and promoting innovation in the financial sector.

Interconnected

The international financial market regulatory framework is constantly being refined in the competent international bodies. Through its active involvement in the framework design, the Federal Council represents Switzerland's interests, also with the aim of improving market access from Switzerland. The Federal Council provides attractive and internationally compatible conditions which ensure that the financial centre has global reach. The Federal Council supports the financial sector in communicating its appeal to an international audience.

Sustainable

For financial service providers, as for all sectors of the economy, sustainable growth in all its aspects is the only viable path for future development. This involves not only the fundamental stability of the Swiss financial sector, its integrity and the effective combating of criminal risks, but also – against the background of the 2030 Agenda and especially climate change – tools to ensure the measurability and transparency of service quality and of effective product prices.

Download the full report

Policy for a future-proof Swiss financial centre

Leading worldwide, rooted in Switzerland: Policy for a future-proof Swiss financial centre

A strong financial centre is key for the Swiss economy and Switzerland's standing as an international location. Switzerland should therefore maintain its place among world-leading, modern and globally active financial centres. The Federal Council wants to assist and support this with a sound and dynamic financial market policy.

Ambition: leading worldwide, rooted in Switzerland

Today, the Swiss financial centre ranks among the most important worldwide and is a major contributor to the Swiss economy. It performs key services for national and international businesses, and for the Swiss population.

The Swiss financial centre today: sound, global, in transition

The figures show that Switzerland currently has a financial centre that provides the Swiss economy with essential services and contributes to the country's international competitiveness.

Trends: more hotly contested, more digital, more sustainable

In recent years, new developments have come to prominence; in the political environment, and particularly in technology. Context and priorities have changed and fracture lines are emerging. The following main trends have emerged:

Strategic thrusts: innovative, interconnected, sustainable

The trends described above will shape the environment for Swiss financial market policy and the Swiss financial centre for the years to come. In terms of the ambition stated at the outset, this yields three strategic thrusts for financial market policy.