Federal Council draws lessons from Credit Suisse crisis and defines measures for banking stability

Bern, 06.06.2025 — The review of the Credit Suisse crisis showed that the too big to fail regime needs to be improved in order to reduce risks for the state, taxpayers and the economy. For this reason, during its meeting on 6 June 2025 the Federal Council determined the parameters for the corresponding amendments to acts and ordinances, which will be submitted for consultation in stages from this autumn onwards. These include stricter capital requirements for systemically important banks with foreign subsidiaries, additional requirements on the recovery and resolution of systemically important banks, the introduction of a senior managers regime for banks and additional powers for the Swiss Financial Market Supervisory Authority (FINMA). The Federal Council also opened a consultation process for those measures that are to be implemented directly at ordinance level.The review of the Credit Suisse crisis showed that the too big to fail regime needs to be improved in order to reduce risks for the state, taxpayers and the economy. For this reason, during its meeting on 6 June 2025 the Federal Council determined the parameters for the corresponding amendments to acts and ordinances, which will be submitted for consultation in stages from this autumn onwards. These include stricter capital requirements for systemically important banks with foreign subsidiaries, additional requirements on the recovery and resolution of systemically important banks, the introduction of a senior managers regime for banks and additional powers for the Swiss Financial Market Supervisory Authority (FINMA). The Federal Council also opened a consultation process for those measures that are to be implemented directly at ordinance level.

Based on Article 52 of the Banking Act and parliamentary mandates, the Federal Council carried out an in-depth evaluation of the regulation of systemically important banks (too big to fail regime) in April 2024 and presented a package of measures in its report on banking stability. In its report of December 2024, the Parliamentary Investigation Committee on “Management by the authorities – CS emergency merger” (PInC) drew lessons from the Credit Suisse crisis and also identified a need for action.

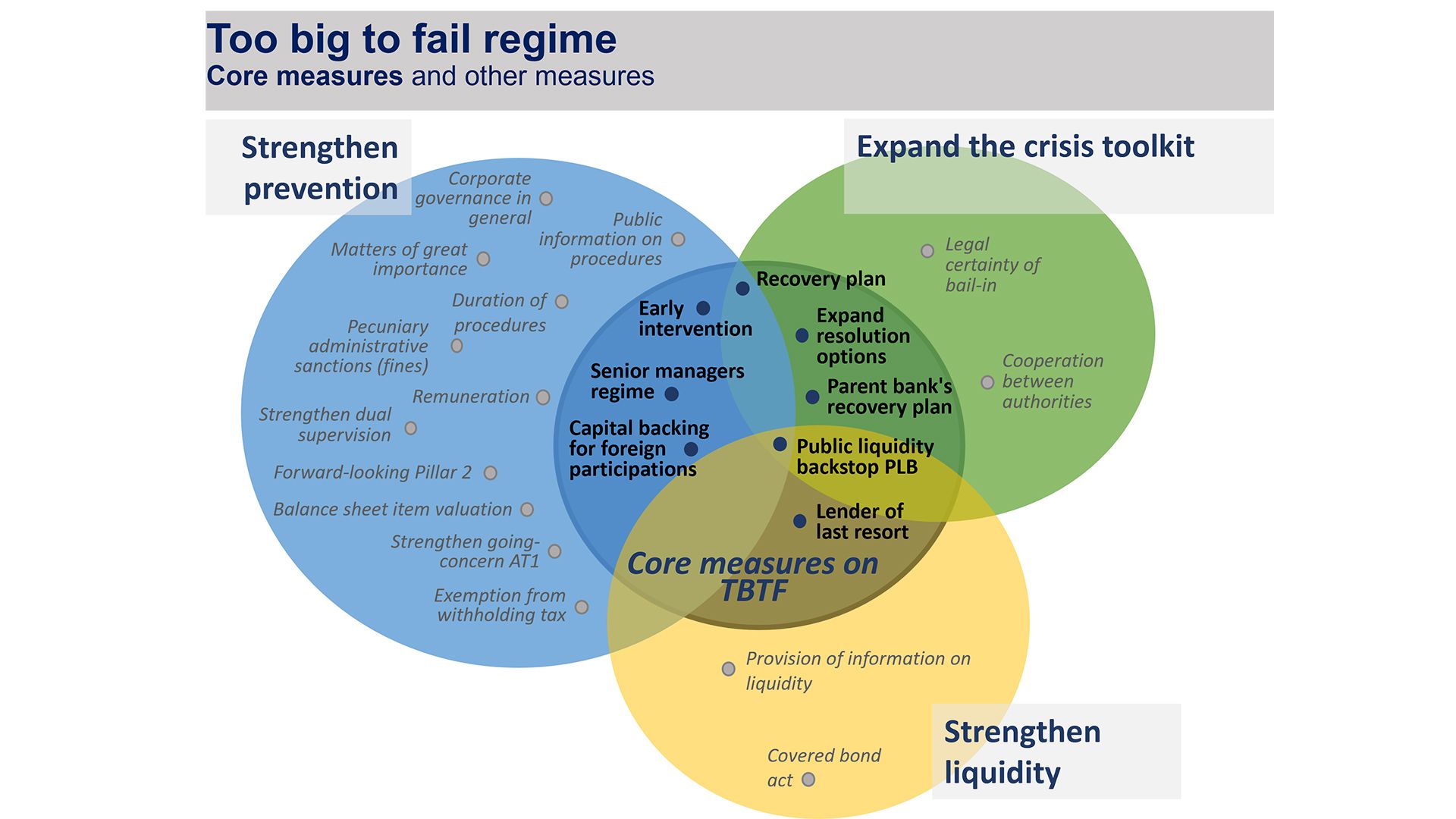

During its meeting on 6 June 2025, the Federal Council set out measures from its report and that of the PInC in detail. The package of measures is intended to strengthen the Swiss financial centre and reduce the risks for the state, taxpayers and the economy. There are measures at both legislative and ordinance level, and all measures are subject to an ordinary consultation procedure.

Measures at legislative level

The introduction of the senior managers regime should further strengthen prevention. Banks must define in a document who is responsible for which decisions within a bank. In the event of misconduct, this makes it possible to clearly assign responsibility and thus impose targeted sanctions, e.g. by clawing back variable remuneration that has already been paid out, cancelling or reducing retained bonuses that have not yet been paid out (see factsheet on remuneration), or, in the case of FINMA, by ordering measures such as withdrawing recognition for guarantees of proper business conduct or prohibiting someone from practising a profession. The additional burden should be minimal for banks with a simple structure.

In addition, the Federal Council has decided to increase the potential for obtaining liquidity via the SNB. On the one hand, legal simplifications at legislative level are to be drawn up with regard to banks' provision of collateral to the SNB. On the other hand, rules are to be introduced at ordinance level which require banks to prepare collateral for obtaining liquidity from the SNB and other central banks. For systemically important banks, this is to be based on a quantitative minimum requirement.

FINMA's supervisory powers are also to be extended. FINMA should be able to order measures earlier and more effectively (early intervention). It should also be able to issue pecuniary administrative sanctions (fines) to non-compliant institutions.

Further, requirements for recovery and resolution plans are to be increased. FINMA should now be able to order measures to remedy deficiencies in recovery planning. The resolution options should also be expanded and enshrined in law.

Further measure at legislative level: Capital backing at the Swiss parent bank for its foreign subsidiaries

Currently, Swiss banks only have to provide partial capital backing for participations in foreign subsidiaries. If these subsidiaries lose value, this also reduces the parent bank's CET1 capital that was not intended for the subsidiaries. This CET1 capital is therefore not available to cover the risks arising from the parent bank's own operating activities. In the Credit Suisse crisis, this meant that an important measure to manage the crisis, namely the sale of certain business areas, could not be realised consistently. This was because the Swiss parent bank would then not have met the capital requirements. As a result, Credit Suisse's strategic room for manoeuvre was severely limited. This would also be problematic for other systemically important banks in a crisis situation.

The Federal Council therefore proposes that, in future, systemically important banks should fully deduct the carrying value of foreign subsidiaries (participations) from the parent bank's CET1 capital (see factsheet on capital requirements). This approach also corresponds to the Swiss National Bank's (SNB) and FINMA's assessment of the capitalisation of parent banks. It ensures that the valuation losses on foreign subsidiaries in the parent bank's balance sheet will not impact on its CET1 capital. At the same time, the measure strengthens the parent bank's capitalisation as the Swiss entity within the group structure. Conversely, as stated in its report on banking stability, the Federal Council has refrained from measures to generally increase capital requirements, which it considers to be less suitable.

Higher capital requirements mean that banks have to replace debt with equity. Two external expert opinions were commissioned by the FDF to estimate the costs of this measure (expert opinion by Prof. Dr. Heinz Zimmermann and expert opinion by Alvarez & Marsal). Zimmermann estimated the impact of higher capitalisation on the weighted average cost of capital under various scenarios. Alvarez & Marsal estimated the impact of the proposed measures on the basis of the data currently available to the public, i.e. the necessary capital increase and the associated costs for UBS. The expert opinion by Alvarez & Marsal provides ranges for the impacts and shows that the costs are significantly influenced by management decisions, among other things.

Measures at ordinance level

The Federal Council has already opened an initial consultation for the measures at ordinance level. For capital requirements, stricter provisions are to apply to the valuation of assets that are not sufficiently recoverable in a crisis, for instance capitalised software or deferred tax assets. The duration and the suspension of interest payments for AT1 capital instruments are also to be defined in more detail.

The consultation procedure is also being used to adjust the liquidity requirements. In order for FINMA and the authorities to be able to assess the situation of banks in a liquidity crisis at any time, the banks concerned should provide complete and up-to-date information and scenario analyses promptly in future.

The measures adopted by the Federal Council at the legislative and ordinance level are targeted and proportionate. They strengthen trust in the financial centre, which, in the view of the Federal Council, is central to its stability and competitiveness.

Next steps

For the legislative amendments, the Federal Council will present consultation drafts based on these parameters in the second half of 2025 (capital backing for foreign subsidiaries in the parent bank) and the first half of 2026 (further measures). In particular, longer transitional periods are planned for increasing capital. In addition, a consultation on amendments to the Liquidity Ordinance will be opened in the first half of 2026 with a view to implementing the new quantitative minimum requirement for obtaining liquidity via the SNB and other central banks.

A consultation on the measures already submitted at ordinance level will be conducted with interested parties by 29 September 2025. These will enter into force in January 2027 at the earliest.